Apple has begun emailing customers who are able to take advantage of sales tax holidays that are coming up in six U.S. states. Those holidays will allow buyers to pick up new Apple products at reduced or zero sales tax.

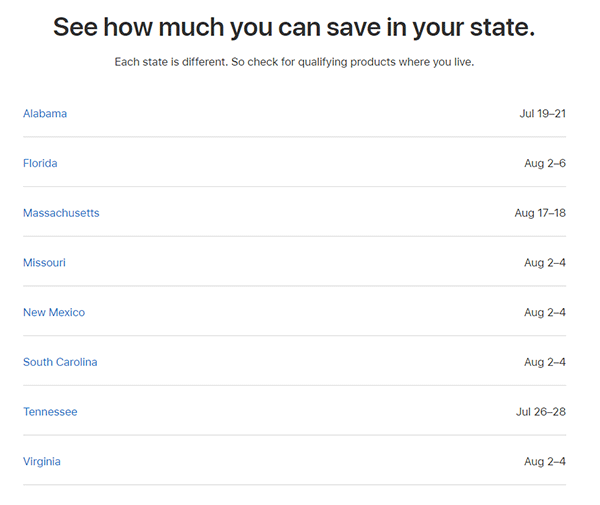

The six states include Florida, Massachusetts, Missouri, New Mexico, South Carolina, and Virginia with all of the holidays taking place in August. Apple has also outlined some of the products that will be available at reduced tax levels in each of the qualifying states. Each of those states has different rules for what can, and cannot, be purchased while making tax savings. Apple also makes things clear on its new tax holiday website, too.

The dates of interest for those able to take advantage of them are:

- Florida – August 2-6

- Massachusetts – August 17-18

- Missouri – August 2-4

- New Mexico – August 2-4

- South Carolina – August 2-4

- Virginia – August 2-4

While not all Apple products will be part of these tax discounts, some items such as Macs, iPads, and accessories will be included. Those in Virginia have the most restrictive tax holiday to deal with – only phone batteries and chargers with values of $60 or less are eligible for tax reductions.

Again, be sure to check out Apple’s tax holiday page for the full lowdown on what you can and cannot pick up as part of this holiday. If you happen to live in the right place, you could definitely save a few dollars here and there.

You may also like to check out:

- iOS 13 Beta 6 / Public Beta 5 Download Release Date: Here’s When To Expect

- iOS 13 Public Beta 4 Download Profile Released To Testers

- Download iOS 13 Beta 5 IPSW Links And OTA Update For Your iPhone Or iPad

- iOS 13 Beta 5 Profile File Download Without Developer Account, Here’s How

- Jailbreak iOS 12.2 Using Unc0ver 3.3.0 IPA

- Install WhatsApp Web On iPad Thanks To iOS 13 And iPadOS 13

- 100+ iOS 13 Hidden Features For iPhone And iPad [Running List]

- How To Downgrade iOS 13 / iPadOS 13 Beta To iOS 12.3.1 / 12.4

- iOS 13, iPadOS Compatibility For iPhone, iPad, iPod touch Devices

- Download iOS 13 Beta 1 IPSW Links & Install On iPhone XS Max, X, XR, 8, 7, Plus, 6s, iPad, iPod [Tutorial]

You can follow us on Twitter, or Instagram, and even like our Facebook page to keep yourself updated on all the latest from Microsoft, Google, Apple, and the Web.